(no subject)

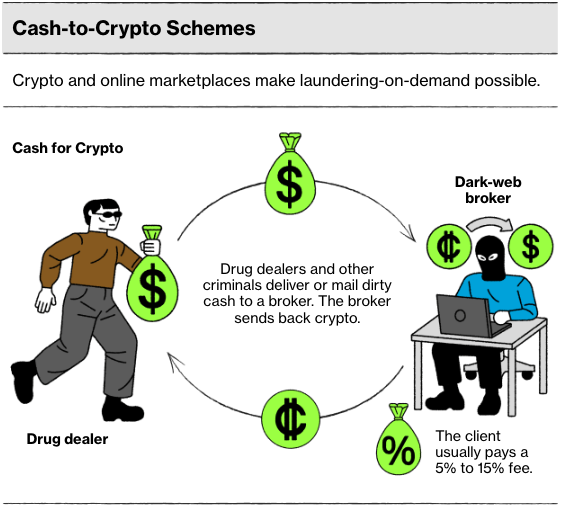

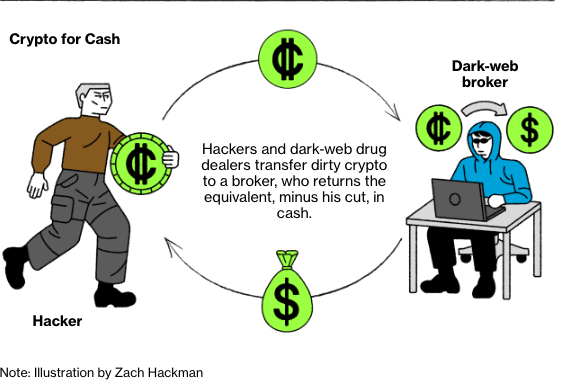

Feb. 11th, 2026 11:05 amPowered by encrypted messaging apps, anonymized platforms and a growing pool of people willing to move money for a cut, the system is agile, scalable and disturbingly hard to shut down. What began a decade ago as a fringe trend on dark-web bazaars is fast evolving into a sprawling global ecosystem of freelance money movers. Even the biggest criminal groups, long reliant on in-house laundering, are starting to tap it.

This is happening while the Trump administration is shifting funding and priorities away from money laundering investigations while also clearing the way for crypto to take a larger role in global finance. That raises the dangerous possibility that laundering operations could slip entirely beyond the government’s ability to police them, several watchdogs and crypto enforcement agents say.

https://www.bloomberg.com/news/features/2026-02-11/drug-cartel-money-laundering-shifts-to-crypto-and-the-gig-economy

Speaking of the Trump administration,

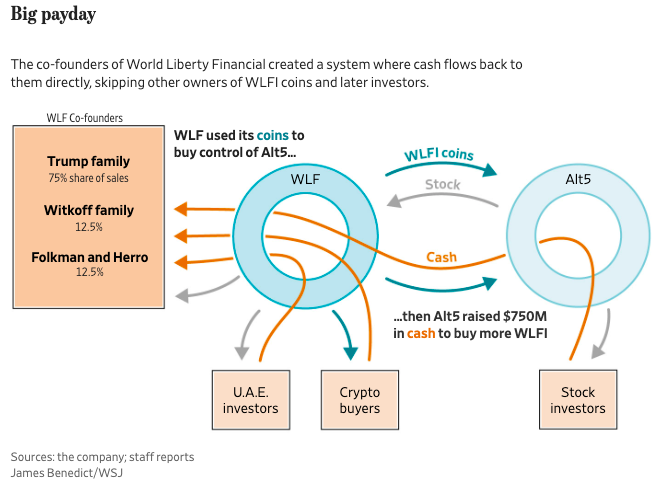

Both the Trumps and Witkoffs began cashing out during the run-up to the inauguration.

On Jan. 16, two lieutenants for Sheikh Tahnoon bin Zayed Al Nahyan, the U.A.E. president’s brother, signed the deal to purchase a 49% stake in World Liberty for half a billion dollars—a huge sum for a company that at that time had no products. Of the upfront installment, $187 million was directed to Trump family entities, while $31 million was slated to flow to entities affiliated with the Witkoff family. The deal didn’t give the Tahnoon-backed entity any rights to the proceeds of future WLFI token sales, preserving the Trumps’ and Witkoffs’ income stream.

World Liberty stopped selling its WLFI token to the public in March. By then, the company said it had taken in $550 million from the token sales, in addition to the U.A.E. investment money.

https://www.wsj.com/finance/currencies/trump-sons-crypto-billions-1e7f1414