The real deal

Oct. 12th, 2019 12:48 pm

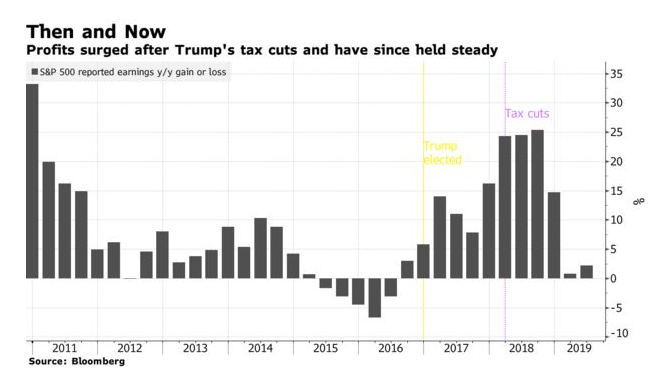

Overall, analysts were predicting S&P 500 companies would earn a combined $146.90 a share in 2018 -- while in the event they booked $157.70. An overshoot that big is exceedingly rare. Estimates for periods so far in the future almost always fall.

...Ten months into 2018, analysts thought profits for the industrial sector would increase 12.5% in 2019. Now, they see a decline of half a percentage point. At that same point last year, Wall Street was forecasting that tech earnings would expand by 14% in 2019. Now, analysts estimate they’ll fall more than 2%, with the change driven by downgrades for trade war-sensitive semiconductor and hardware stocks. Meanwhile, software and services stocks, seen as more insulated from the U.S.-China spat, have maintained forecasts for profit growth above 16%.

https://www.bloomberg.com/news/articles/2019-10-12/trump-s-fixation-on-buttressing-1-5-trillion-in-company-profits

This looks more and more like a one-time deal, esp. if Warren is elected and corporate profits flow back into taxes. Corps will fight her tooth and nail.